Estimating building permit fees accurately is crucial for Florida construction projects. Contractors, insurance adjusters, and construction attorneys often need to budget permit costs for bids or claims. However, permit fee structures vary widely across Florida jurisdictions, and underestimating these fees can lead to surprises[1]. This article provides an impartial, informative guide to what permit costs include, how fees differ for new construction vs. remodels, common estimating mistakes, and tips to avoid underestimating permit fees in Florida. Real examples (from 2024 fee schedules in Tampa, Wellington, Orange City, Brevard County, etc.) are included to illustrate typical costs.

What Do 'Permit Costs' Include?

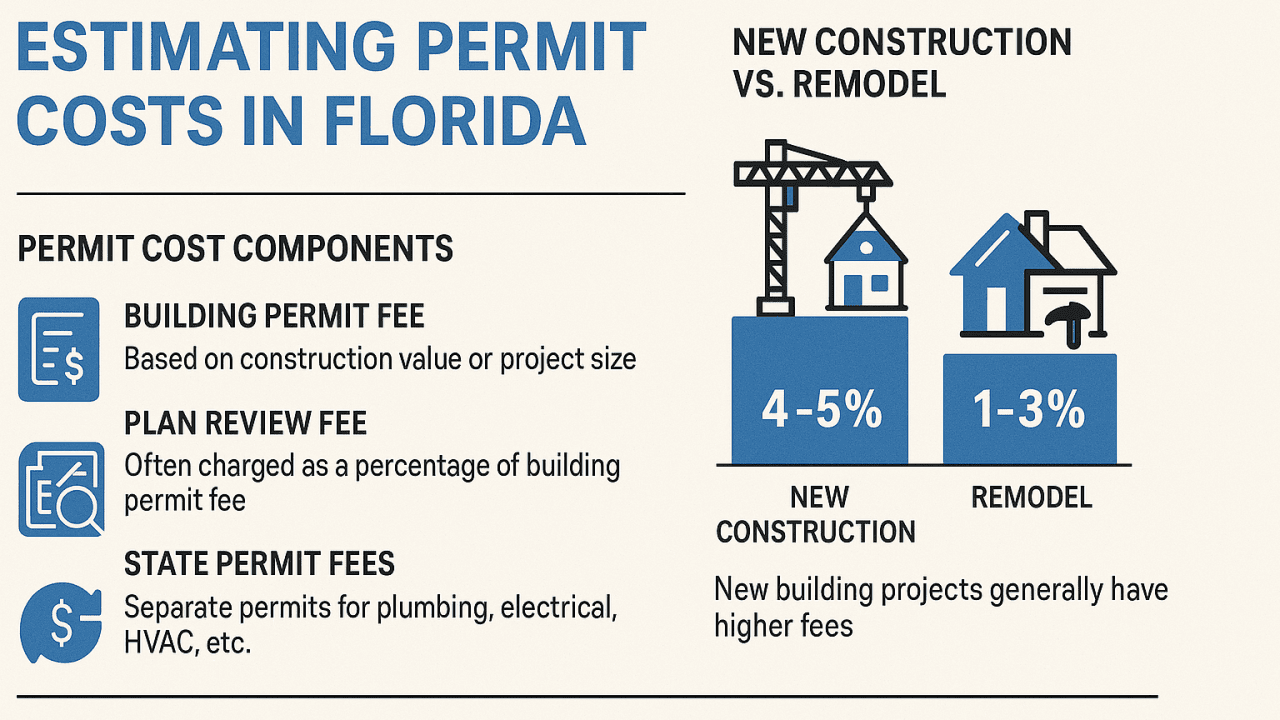

When we talk about permit costs, we mean all the fees associated with obtaining building permits for a project. In Florida, permit costs typically consist of several components:

- Building Permit Fee: The core fee for the building permit itself, usually based on the project’s construction value or size. This covers the government’s cost to review plans and inspect the construction. Each city/county sets its own formula or rate (e.g. a percentage of project value or a rate per $1,000 of value)[2].

- Plan Review Fee: Many jurisdictions charge a separate fee for reviewing plans. Often this is calculated as a percentage of the building permit fee (commonly 50% in many Florida cities[3]) or a rate per value. For example, Wellington, FL requires the plan review fee to be 50% of the building permit fee (minimum $75)[4]. This fee is usually paid at application and covers the initial plan-check process.

- Trade Permit Fees: In addition to the main building permit, individual trade permits may be needed for electrical, plumbing, mechanical, gas, or fire systems (unless the jurisdiction’s fee structure “bundles” these into one). Each trade permit can carry its own fee. Example: In some Florida cities, a new single-family home might require separate plumbing, electric, and HVAC permits – often with base fees around $85–$135 each[5]. If these trade fees aren’t included in your estimate, the total permit cost will be too low.

- State Surcharges: Florida law mandates a surcharge on building permits to fund building code enforcement and training. All permits statewide incur a 2.5% surcharge (combined, on the permit fee) – 1.5% for the Building Code Administrators and Inspectors Fund and 1% for the Building Code Education Fund[6]X. This is usually a small amount (minimum $4), but it must be added to every permit cost.

- Impact and Mobility Fees: For new construction (and certain additions), counties and cities often assess impact fees (or similar mobility fees) to fund infrastructure like roads, parks, schools, and fire services. These are one-time fees collected with the permit or before the Certificate of Occupancy[7]. Impact fees do not apply to simple interior remodels, but for a new building they can be substantial – often thousands of dollars. For example, a new 2,500 sq. ft. home in Orlando would incur roughly $7,000 in transportation impact fees, $2,500 for sewer, $11,000+ for school impact, plus park fees[8] – easily $15k–$20k extra on top of the permit. Always determine if impact or mobility fees apply to your project’s location and scope.

Permit Fee Structures Vary by Florida Jurisdiction

Florida has over 400 municipalities and 67 counties, each with its own permit fee schedule. There is no single statewide rate – you must check the local schedule. Here are a few examples of how permit fee structures differ in various Florida jurisdictions:

- City of Tampa: Tampa’s Construction Services Division uses a comprehensive fee schedule that includes all trades (building, fire, electrical, plumbing, gas, mechanical) in one combined permit fee for a new building[9]. Fees are primarily based on project value. For instance, Tampa’s schedule (2025) indicates a base permit fee of $50 for the first $1,000 of project value, plus about $5 for each additional $1,000 in value (roughly 0.5% of construction value)[10]. Tampa also adds the mandatory 2.5% state surcharge on the permit fee[11]. (Impact fees for transportation, schools, water/sewer connections, etc., are assessed separately by the county or city – Tampa provides links to these on its site[12].) Tampa even offers an online Permit Fee Estimator tool to help calculate fees for common project types[13].

- Village of Wellington: Wellington uses a tiered formula based on construction value. The building permit fee starts at a $150 minimum for projects up to $7,500, then 2.0% of value from $7,500 to $100k, 1.75% from $100k to $500k, 1.5% from $500k to $1.5M, and 1.25% beyond that[14]. This valuation includes all construction components (structural, electrical, plumbing, etc.)[15]. Plan review is charged at 50% of the permit fee (minimum $75)[16]. On top of that, Wellington applies the state surcharges of 1% + 1.5% on the permit fee[17].

Example: A $100,000 addition in Wellington would have a permit fee about $2,000, plus ~$1,000 plan review and $75 in state fees – roughly $3,075 total in permit-related fees (about 3% of value).

- Orange City: Orange City’s fee schedule shows different rates for new construction vs. remodels. For one- and two-family homes, the building permit fee for a new dwelling is $4.50 per $1,000 of value (0.45%) with a $75 minimum [18]. For residential remodels or additions, the rate is higher: $6.40 per $1,000 (0.64%)[19] – likely because smaller remodel projects still require administrative effort. Plan review in Orange City is relatively low, e.g. $0.50 per $1,000 of value for residential (min $50)[20]. Commercial projects have their own rates (around $6–$7.50 per $1,000 for permits, and $1.75 per $1,000 for plan review)[21]. Orange City also charges the Florida surcharges (listed as 1.5% + 1.5% of permit fee, per their 2022 document)[22]. This means Orange City’s fees, as a percentage, can be quite modest. For example, a $50,000 home remodel would incur about $320 for the permit and $50 for plan review (plus ~$8 state surcharge) – only around $378 total (under 1% of the project) by the city’s formula.

- Brevard County: Brevard County uses a base fee + value model and also lists various departmental review fees. For a commercial or residential building permit, Brevard’s schedule (2025) shows an application processing fee $25, plus a Building Code fee of $100 for the first $1,000 of job value, and $5.25 per $1,000 thereafter[23]. (This works out to roughly 0.525% of construction value, with a $100 minimum.) On top of that, the state surcharge 1.5% + 1% is applied to the “Building Code” fee total[24]. Brevard also itemizes other reviews: e.g. Zoning review $210, Concurrency review $175, Fire review fee $52 + 0.34% of job value[25], and utility or environmental reviews if applicable[26]. Impact fees in Brevard are collected separately before final inspection (and depend on the project type)[27]. Example: For a new commercial build valued at $300,000 in unincorporated Brevard, one might estimate ~$1,668 in building permit fees, ~$42 in state surcharge, ~$1,072 in fire review, $210 zoning, $175 concurrency, etc., totaling around $3,200 (excluding impact fees) for permits and reviews. A simpler residential remodel in Brevard (say $50k value) would pay roughly a few hundred dollars in permit fees.

As you can see, permit costs can differ drastically: some cities charge a higher percentage of value but include most items in one fee, while others have lower rates but add multiple smaller fees. Always refer to the specific city or county’s latest fee schedule for accurate numbers. Below is a comparison table of estimated permit fees in four Florida jurisdictions:

New Construction vs. Remodeling: Key Differences in Fees

Permit costs for new construction are usually higher than for remodels, both in absolute dollars and often as a percentage of project cost. Several factors explain this:

- Impact Fees: As noted, impact fees are typically required for new buildings (e.g. new houses, new commercial structures) to offset the “impact” on public infrastructure. Remodels that don’t add square footage or dwelling units generally do not trigger impact fees[36]. This alone means new construction often carries thousands more in fees. For instance, building a new home in a Florida county could incur 4–5% of the total project cost in impact fees, whereas a renovation project would pay $0 in impact fees[37].

- Building Permit Calculations: Some jurisdictions charge different rates for new builds vs. alterations. In the Orange City example, the city charges $4.50 per $1k for new residential construction but $6.40 per $1k for remodels[38]. However, because a new build’s value is usually much larger, the total permit fee will still be higher for new construction. Many places (like Tampa, Wellington, Brevard) use the same formula for any building permit based on value – but the new build will simply have a higher value to calculate against. Moreover, any minimum fees per permit (for trades, etc.) will stack up more for a new build (since you need all new systems) whereas a small interior job might only pull one or two permits.

- Additional Reviews: New constructions often involve more plan reviews and inspections – e.g. initial site plan, infrastructure, fire safety, environmental or concurrency reviews – sometimes each with their own fee. Remodels, especially interior-only ones, can bypass many of these. For example, a new building in Brevard had fees for fire, zoning, concurrency, etc., in our example, whereas a straightforward remodel might only pay the base building permit and perhaps a zoning review if changing footprint[39].

Percentage of project cost:Taking all the above into account, remodel/renovation permit fees typically run around 1–3% of the construction value, whereasnew home construction permit+impact fees often run 4–5% (or more) of the total project costin Florida. In one homeowner’s case, a builder initially underestimated permit and impact fees on a new house by $4,500 – highlighting how significant these costs can be[40]. As a general rule:

- A minor interior remodel (no added area) might see permit costs closer to 1% of its value (especially for larger-value remodels in jurisdictions with low rates[41]). Smaller jobs could be a higher percentage due to minimum fees, but still usually within a few percent.

- A major addition or renovation (adding square footage) may incur 2–3% in permit fees. If the addition creates new dwelling units or significant impact (e.g. converting a garage to living space in some areas), there could be additional fees (like impact fee for an added dwelling unit or increased utility load).

- New single-family homes commonly see total permit-related costs in the range of ~4–5% of the construction budget in Florida[42]. This includes building permit, plan checks, trades, state fees, and typical impact fees. High-impact fee locales can push this higher (5%+), whereas areas with minimal impact fees (or fee reductions) might be a bit lower.

Common Estimating Errors to Avoid

Even experienced professionals can miss some of the permit costs if they’re not careful. Here arecommon errorsin estimating permit fees – and how to avoid them:

- Omitting Trade Permit Fees: Don’t assume the main building permit covers everything. Many Florida jurisdictions require separate permits for electrical, plumbing, mechanical, gas, roofing, etc. For a new house, it’s not unusual to have 4–6 permits. Always include the fees for each required trade permit. These might be flat fees (e.g. Orange City’s minimum $75 per trade[43] or Indian Harbour Beach’s ~$85 base for single-family plumbing/electric[44]) or value based. Solution: Check if the city’s fee schedule bundles trades or not. If not, add each one’s cost. When in doubt, call the building department to clarify which separate permits (and fees) will apply to your scope.

- Misjudging Plan Review Fees: A very common mistake is forgetting that a plan review fee is due or underestimating it. As noted, many areas charge plan review at 50% of the permit fee[45]. If you only budgeted for the permit itself, you’ll be off by a significant margin. Other cities might charge plan check by the hour or a small per-square-foot fee, but there will likely be something. Solution: Always double-check the plan review policy. If it’s a percentage, calculate it. If it’s hourly, consider the complexity of your project (e.g. a commercial project might incur multiple discipline reviews). Budget conservatively for plan review – it’s better to overestimate slightly than to miss it entirely.

- Ignoring the State Surcharge: It’s only a couple of percent, but it’s required by law on every permit. For instance, Tampa’s website prominently reminds users of the 2.5% Florida Building Permit Surcharge on all permits[46]. If your permit fees are large (say a $20,000 permit fee on a big project), this surcharge can be an extra $500. Solution: Always tack on that 2.5% at the end of your fee calculation. (Note: some fee calculators or schedules show fees before surcharge and then add it, so ensure your final number includes it.)

- Forgetting Impact Fees (for New Construction): This is a big one in new development budgets and insurance replacement cost claims. Impact fees might be handled by a different department or at the end of the project, so they can be “out of sight, out of mind” during initial budgeting. Don’t let that happen. For example, Hillsborough County notes that mobility/impact fees are assessed prior to permit issuance for new development[47] – if you didn’t account for them, your project will be short on funds to pick up the permit. Solution: Research the impact fees for the project type and size early. Most counties publish impact fee schedules (often based on unit count, square footage, or bedrooms for residences). Include a line item for these in any estimate for a new building. Remember that even large remodels that increase square footage significantly could incur a partial impact fee (for added traffic, etc., depending on local rules).

- Using Outdated Fee Schedules: Florida municipalities update their fee schedules, typically annually or biannually. Estimating based on an old schedule can lead to error. For example, if a city raises its permit rate from say $5 per $1k to $6 per $1k, that’s a 20% hike. Solution: Always obtain the current fee schedule (2024 or latest) from the city’s official website. The sources cited in this article (Tampa, Wellington, Orange City, etc.) are recent as of 2024–2025. When preparing an estimate or a claim, double-check if any fee changes have occurred. If in doubt, call the building department to confirm current rates.

- Not Tailoring Estimates to the Project Type: Ensure you’re applying the correct fee formula for your project. For instance, some locales have different fee tables for residential vs. commercial, or new vs. alteration. If you mistakenly use the residential rate for a commercial project, your number could be off. Solution: Read the fine print in fee schedules – identify which category your project falls into. If a project has mixed components (e.g. a new addition plus interior remodel of an existing space), there may be multiple permits or blended calculations.

- Overlooking Miscellaneous Fees: These might include minor fees that can add up: such as zoning plan approval fees, tree removal permit (if clearing a lot), driveway/ROW permit fees, or utility connection fees (if pulling new water meter, etc.). While not “building permit” fees per se, they often coincide with the building permit process. For example, a new build might require a $100 address assignment fee (Brevard County example[48]), or a county might charge a drainage review fee. Solution: Review the entire application checklist. If the permit application references additional reviews or permits (right-of-way, utility, fire marshal, environmental), include something for those fees as well.

By being aware of these pitfalls, you can greatly improve the accuracy of permit cost estimates.

Tips to Avoid Underestimating Permit Fees

To wrap up, here is a summary ofbest practicesand tips for contractors, adjusters, and attorneys when dealing with permit cost estimation:

- Start with Official Data: Always base your estimate on the official fee schedule or calculator of the jurisdiction. Most Florida cities/counties publish their fee schedules online, and some (like Tampa) have fee estimator tools[49]. Bookmark the relevant websites for quick reference.

- List All Required Fees: Use a checklist of potential fees: building permit, plan review, each trade permit, state surcharge, impact fees, and any special local fees (fire, utility, etc.). Go through this list for every project to ensure nothing is missed. It helps to create a template. For example: “Building permit = $__ (per formula), Plan review = $__ (x% of permit), Electrical permit = $, Plumbing = $, Mechanical = $, State surcharge = $, Impact fees = $, Other = $.”

- Differentiate New Construction and Remodels: Recognize when a project will trigger extra fees. New constructions, additions, or change-of-use projects will have more fees (impact fees, site reviews) than an interior renovation. Allocate a higher percentage or lump sum for permits on new builds (around 5% of build cost as a rule of thumb, unless you have precise local figures)[50]. For remodels, 1–3% is often sufficient[51] – but again use local specifics when available.

- Verify with the Building Department: When in doubt, don’t hesitate to call the local building department’s permitting office. They can often confirm the major fees if you provide project details. This is especially useful for unique projects that don’t fit neatly into published tables. Some jurisdictions even allow you to submit preliminary permit info to get a fee quote.

- Consider Hiring a Permit Runner or Consultant: For complex projects or if you’re an adjuster not familiar with a particular locale, a permit expeditor or consultant can help identify all required permits and fees. Their insight can prevent costly omissions. They might also be aware of local nuances (e.g. “City X charges a flat $Y fire inspection fee for commercial permits”).

- Account for Fee Reductions or Exemptions: In some cases, you might be eligible for reduced fees – for instance, Florida law requires jurisdictions to reduce permit fees if you use a private provider for code inspections or plan review[52] (since you’re taking some workload off the building department). Also, rebuilding after storm damage might qualify for waived fees in certain emergency ordinances. These situations are not common, but if they apply, they can lower costs. Just be cautious and get official confirmation before assuming any discounts.

- Document Fees for Insurance Claims: If you are an adjuster or attorney dealing with an insurance claim, make sure to itemize the permit fees as part of the reconstruction cost. Florida law generally allows recovery of reasonable permit fees in property damage claims. Cite the city’s schedule or invoice as proof. This will help avoid disputes about whether the permit cost is justified. It’s also a good practice for contractors to show permit costs as a separate line in bids, so owners understand this is a real, necessary expense backed by local fee schedules.

- Allow a Contingency: Finally, it’s wise to include a small contingency for permit fees in your budget (especially if dealing with preliminary estimates long before pulling the permit). A 10–15% contingency on the calculated fees can cover any unforeseen extra minor permits or slight changes in valuation that increase the fee. Any unused portion is a bonus, but if something was overlooked, you have a buffer to cover it.

By following these best practices, you can confidently estimate permit costs and avoid the common pitfalls that lead to underestimation. In summary, do your homework on local fees, include all the components, and double-check your work. Accurate permit cost estimates will ensure your project budgets and insurance claims are on target, preventing surprises down the line.

Sources:

Official 2024 fee schedules and guides from

City ofTampatampa.govtampa.gov,

Village ofWellingtonwellingtonfl.govwellingtonfl.gov,

City of OrangeCityorangecityfl.govorangecityfl.gov,

BrevardCountybrevardfl.govbrevardfl.gov;

Florida Statutes (Sections 553.721 & 468.631) via localcitestampa.gov;

Hillsborough County and Orlando impact feedocumentshcfl.govetminc.com; and

various Florida permitting resources.

These examples reflect the diversity of permit fee structures and the importance of referencing current, official data when estimating.

[1]houzz.com

[2]wellingtonfl.govorangecityfl.gov

[9]tampa.gov

[11]tampa.gov

[12]tampa.gov

[13]tampa.gov

[14]wellingtonfl.gov

[15]wellingtonfl.govwellingtonfl.gov

[16]wellingtonfl.gov

[17]wellingtonfl.gov

[18]orangecityfl.gov

[19]orangecityfl.gov

[20]orangecityfl.gov

[21]orangecityfl.gov

[22]orangecityfl.gov

[23]brevardfl.govbrevardfl.gov

[24]brevardfl.gov

[25]brevardfl.gov

[26]brevardfl.gov

[27]brevardfl.gov

[28]tampa.gov

[29]wellingtonfl.govwellingtonfl.gov

[30]orangecityfl.govorangecityfl.gov

[31]brevardfl.govbrevardfl.gov

[32]suncoastpermits.comtampa.gov

[33]wellingtonfl.govwellingtonfl.gov

[34]orangecityfl.govorangecityfl.gov

[35]brevardfl.govbrevardfl.gov

[36]hcfl.gov

[38]orangecityfl.gov

[39]brevardfl.gov

[40]houzz.com

[41]orangecityfl.gov

[42]jamesmadison.org

[43]orangecityfl.gov

[45]wellingtonfl.gov

[46]tampa.gov

[47]hcfl.gov

[48]brevardfl.gov

[49]tampa.gov

[50]jamesmadison.org

[51]wellingtonfl.govorangecityfl.gov

[52]strategiceng.us